Contents

- What is an Investors Directory?

- Why Should I Build a Similar Platform?

- Key Benefits of Building a Site like Crunchbase

- Building a Investors Directory on WordPress: Launch in 1 Day

- Step#1: Install and Activate Directorist

- Step#2: Install and Activate Directory Theme

- Step#3: Create Your Directory

- Step#4: Add Listing and Empower Users

- Step#5: Use Scrapper to Get More Data

- Step#6: Enable Monetization and Activate Payment Gateways

- Step#7: Secure Your Directory

- Step#8: Start Earning from your Directory

- How to Promote Your Investors Directory

- Marketing Ideas to Grow Your Investors Directory

- Wrapping Up

How to Build and Grow an Investors Directory like Crunchbase on WordPress

Did you know that,

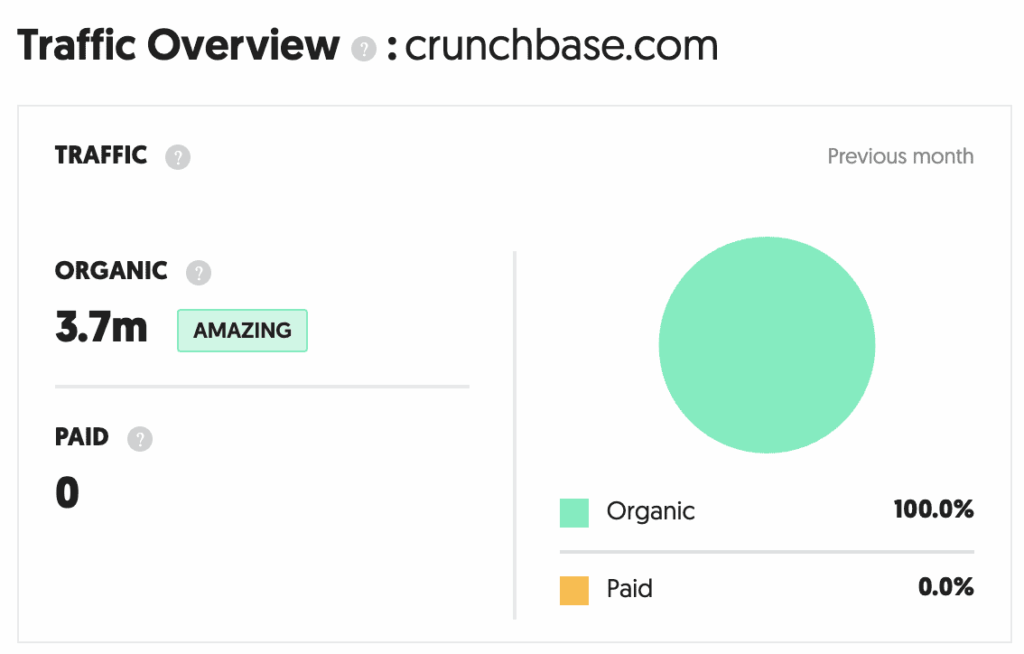

Crunchbase attracts over 3.7 million organic visitors every month? (Source: Ubersuggest)

Millions of entrepreneurs, investors, and startups search for funding opportunities, market insights as well as networking possibilities – all in one place. Crunchbase is not just a database; it’s a powerful ecosystem that connects ideas with capital. And that’s not the only investors directory in the world.

Startups and venture capital firms are largely dependant and they need platforms to connect with each other. While Crunchbase is the leading one, there are more like Capboard, Startup Investors Directory and Private Equity List. The list goes on and if you are reading this, I can assure you that you know a handful of investors too.

Now, if you wish to capitalize on your knowledge base, professional network and aim to make money by building a similar platform, I will say you are in the right place. Because, today I am going to describe how you can build an investors directory on WordPress within 1 day with a little technical knowledge and turn it into a passive income source.

Bear in mind, this is not a shortcut to success. You will need to have networking ability, deep understanding of how startups and venture capital firms work and most importantly, build a reliable investment companies list to get to the end of it. Don’t worry, I have few tips for that as well. So let’s deep dive into it without further delay.

Related: Checklist Before Building a Directory Website

Table of Content

- What is an Investors Directory?

- Why Should I Build a Similar Platform?

- Key Benefits of Building a Site like Crunchbase

- Building a Investors Directory on WordPress

What is an Investors Directory?

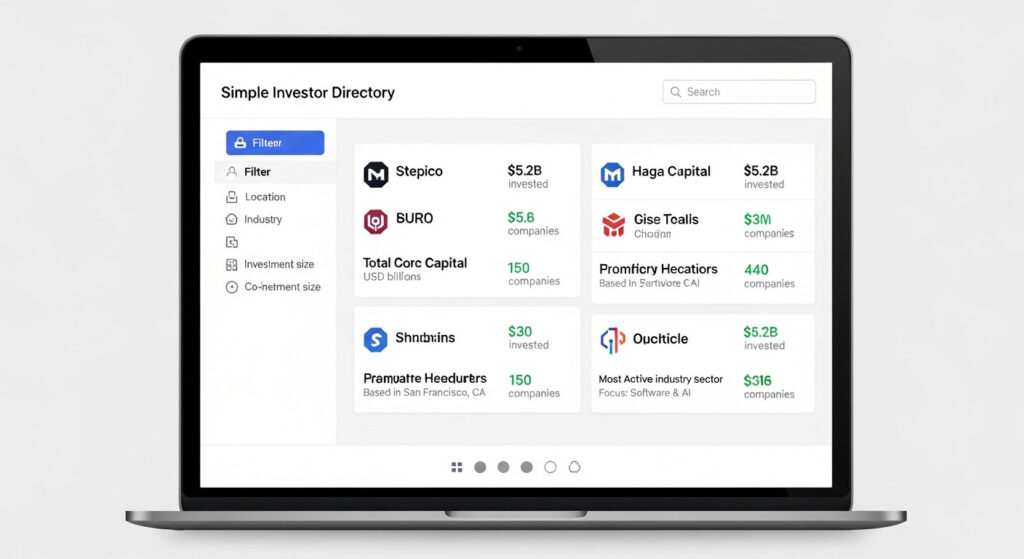

Investors directory are the directory website that list venture capitals firms, investment companies, angel investors and startups that seek capitals. We already mentioned a few names that you can visit to get a more detailed idea. Simply put, they offer a bridge to connect small enterprises, startups and tech companies to financial corporations to streamline raising investment quickly.

For that purpose, they need to contain a lot of authentic information including firms name, primary location, people who work closely with the firm, their biggest and successful fundings, companies they have funded, industries they work with etc. Plus, they also contain contact information so that startups can connect to them easily instead of cold outreach or other lengthy procedures.

In essence, an investors directory functions as a centralized platform of information and networking where entrepreneurs can discover who’s actively investing, what kind of startups they’re interested in, and how to reach out. This is why Crunchbase were able to attract so many traffic without promotion in the first place. People like and trust what they offer and buys plans to get them.

Why Should I Build a Similar Platform?

Good question. Although there are so many databases containing investors, VC firms and startups, the need of a similar platform is still there. Specifically if you are focused on regional businesses or a particular geolocation, you will find the gap in the market.

Capboard, Crunchbase or Private Equity list simply contains information that are relevant to global scale businesses and startups. They do not cater small, regional ventures such as local healthcare startups, eCommerces, marketing and technology companies. But they need investments too. Often they seek small funds that they can get from regular VC firms.

But they lack knowledge because VC firms don’t usually promote their businesses a lot. Due to nature of heavy financial transactions, various risk factors, they tend to lay low and focus on discovering potential businesses that have gone missing in big firms radar. The discovery can be made easier if you build a regional investment hub, a niche angel investor network, or a global funding directory for them.

You might be wondering what’s your benefit in this? Primary benefit is of course monetary. You can earn money in various ways using it. Plus, it helps you build an even stronger network, making you a powerful personality, helping you to excel in professional career.

Key Benefits of Building a Site like Crunchbase

Ask the crunchbase founders, how much are they making from those 3.7M organic traffic each month. Website traffic doesn’t necessarily mean earning but consider a 10% of those traffic converting into a pro subscription plan, using the strength of the platform to connect to their counter part. That’s 370,000 subscriptions each month.

This is just one, there are plenty other benefits of building a platform like this. Here are few key benefits you can avail by building an investor listing website.

- Passive Income: You don’t need to quit your regular work to build and maintain a listing website. You can do it in your free time and even earn when you are not active. This is a great passive earning tool.

- Strong Networking: While building your VC listing, you also get to build a strong professional network consisting of founders, angel investors, venture capital firm’s management and other professional stakeholders.

- Career Growth: It helps you grow your own career, make decisions on the crossroads whether you will turn your directory into a full-time business or stick to your regular job. The networks you built in the process can help you find new opportunities.

- Rapport Building: Investor listing platforms help startups and investors build rapport and long-term professional relationships through transparent, data-rich profiles.

Besides, you have a long term sustainable business that can create more employment opportunities and contribute to your national economy as well. But, how much investment do you need to get started with a platform like this? I suppose that’s not significant. With the guidance I will share, you can do it within shortest time by spending very low.

My idea of building an investors directory is on WordPress. Because WordPress is beginner-friendly, open source and has oceans of tools to customize and tailor your platform to fit your business model. WordPress also gives you the flexibility to reduce costs if you are strategic. So let’s learn how to build a site like Crunchbase on WordPress below.

Building a Investors Directory on WordPress: Launch in 1 Day

There are plenty of WordPress plugins to build directories and listing websites. I will be using Directorist, a powerful, feature-rich and highly customizable suite to build the perfect Crunchbase alternative. You can get started with the free plan to build your site. Choose a pro plan later if you need to utilize the extensions to make your site more dynamic.

I am assuming that you already know how to setup your hosting, install WordPress and install a plugin on WordPress. Therefore, I will start from activating Directorist as my step#1 and continue. Please comment below if you think I need to provide previous steps as well.

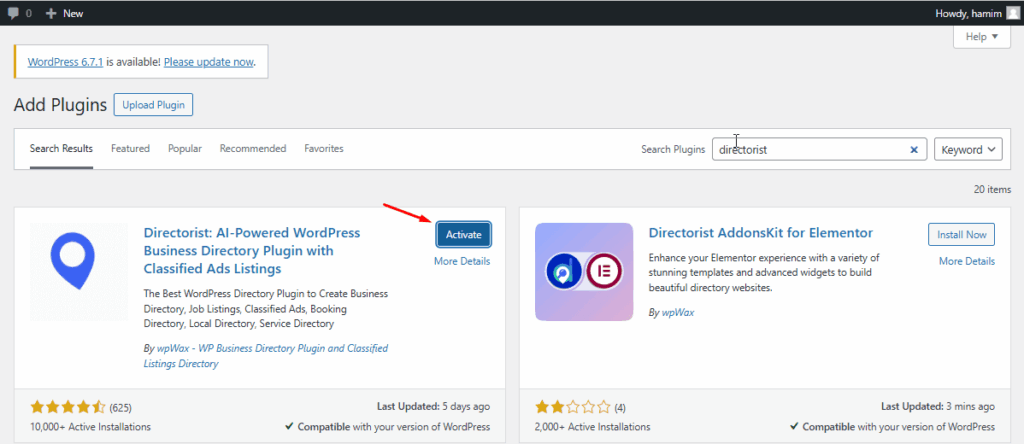

Step#1: Install and Activate Directorist

Directorist plugin can be installed and activated from your WordPress dashboard. Upon installing the free plan, activate it and navigate to step 2.

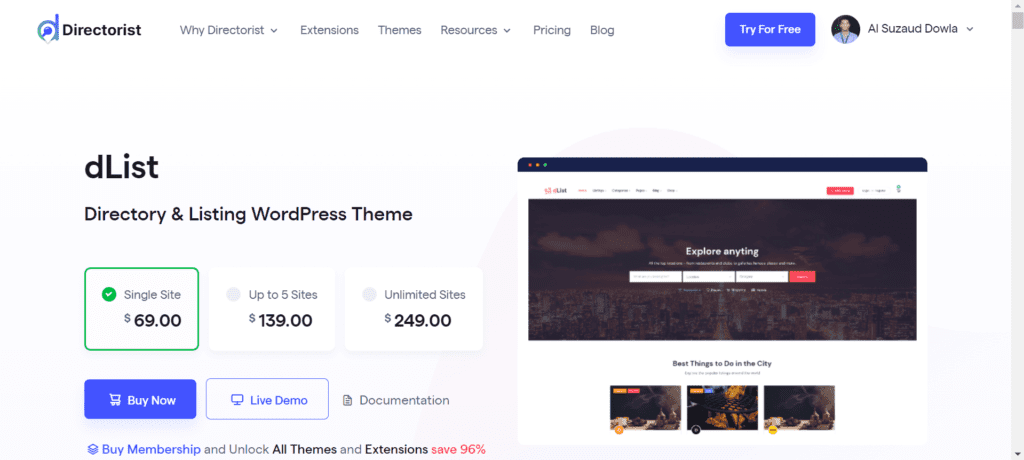

Step#2: Install and Activate Directory Theme

When you install WordPress, you automatically get a theme with it. But to build the investors directory, you need a suitable theme. Our recommendation is dList, which is a Directorist-based pro theme. You can buy it for $69/year for a single site to get started. Other suitable plans are also available.

When you are done with installation and activation of the theme, navigate to step 3.

Step#3: Create Your Directory

Creating directory is flexible with manual from scratch as well as AI builder options. You can utilize either to build the perfect directory including all required form fields and even custom fields.

See Documentation: Getting Started with Setup Wizard

Step#4: Add Listing and Empower Users

You can start adding your investors on the directory one-by-one from backend or import a bulk list using the import/export tool. Or enable frontend submission if you want investors to create their own profile. For starters, you should aim to do it on your own for accurate data submission.

Step#5: Use Scrapper to Get More Data

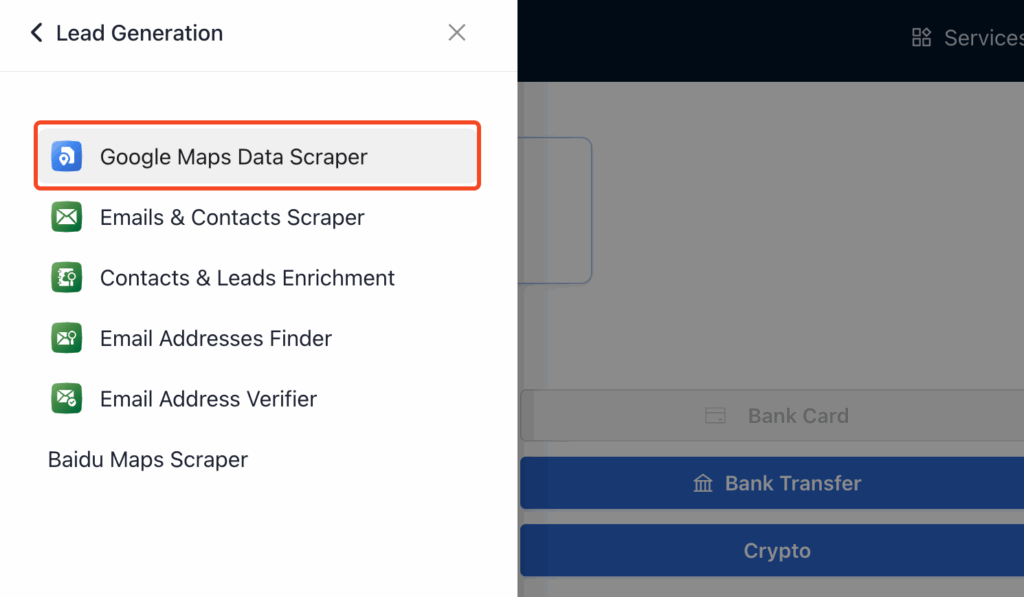

Use tools like Outscraper to scrap data to populate your listings further. This will allow you to enhance your directory quality further.

Step#6: Enable Monetization and Activate Payment Gateways

Use Pricing Plan extensions to create membership plans for users to enable your monetization option. You can also collect payments using popular gateways like PayPal, Stripe and Authorize.net.

Step#7: Secure Your Directory

Your directory contains valuable information. So you need to secure information using Private Directory feature. Lock them behind paywalls so that users purchase various plans to unlock contact information. Also enable Google reCAPTCHA to prevent bot submissions.

Step#8: Start Earning from your Directory

This is the ultimate goal; starting to earn from your listings. How? You have got multiple methods to extract money from users:

- Private Directory: Keep your investors list private so that users require signing up and buying membership plan to access data.

- Claim Listing: Let investors claim their profile on your site by paying a fee.

- Live Chat: Integrate Live Chat so that investors and businesses can directly communicate on your platform without any formal contract.

- Appointment Booking: Enable users to book appointment directly with investors using Booking option. You can charge per appointment booked.

That’s it! Your investors directory website is all set within a day. Want to grab the bundle of Directorist extensions and themes? Visit our Pricing pages and explore your suitable plan.

How to Promote Your Investors Directory

Now comes the tough part; populating your site with more rich data and bring quality traffic. Because without quality traffic, your website will become just another directory. Surely you don’t want that. You need a promotion plan to increase traffic, keep users engaged and finally, convert them to paying customers.

Related Article: How To Promote Your Newly Launched Directory Site

In order to develop your promotion plan, first you need to identify a few things:

- Your Ideal Audience/Target Group: Who are most likely to visit your website.

- Buyer’s Persona: Who are most likely to buy information from your directory.

- Value Proposition: What value do you offer to help or benefit the customers/visitors.

- Competitive Advantage: What do you offer that’s unique or more beneficial than your competitors.

- Pricing Plans: How much can you charge customers to convert and make profits.

Let’s get to the details of it.

1. Target Group

Since you are developing a investors directory, you can build multi-directory that consists 1. Investors and VC Firms list, 2. Startups and Businesses that are seeking investments. This way you can bridge both capital firms and startups and make them both your ideal customers. However, you also need to look at the demographics and other factors like:

- Location: Which region are you aiming? Are you focused on connecting a national/regional startups network to same area’s VC firms? Or it will be a global platform where any investors from Los Angeles, CA can invest in a small startup in Manilla, Philippines? Make that decision quickly before populating data.

- Business Size: There are various startup sizes, some deal with Millions of revenue a month and some can get ten grand at most a month. Some has a team sizes of 100+ and some has only 3. Which tier are you focusing? Or will it be of all sizes? Are you considering unicorns as your customers as well?

- Industry: There are limitless industries where businesses can grow. Whether it’s tech and software or agriculture and real estate, are you going to focus on them all? Or you only want to help AI startups to raise funds for their next innovation? Your call.

When you make this decisions up, you have a definite target group in hand.

2. Buyers Persona

Your buyers persona contains an imaginary customer whose traits, behaviours, purchasing habit, pain points and digital activities align with your offering. In other word, the person who is most likely to come to your directory, click on a listing whether it’s a startup listing or a VC firms listing and finally make a transaction to connect to that listing owner.

If you are going to work with both startups and VC firms, you need to develop at least 2 buyers persona; one of the startup founder and one of the VC business growth lead.

- Startup Founders Persona: Name, Age, Gender, Location, Industry, Habits, Skills, Digital Activities, Business Size, At what stage of fundraising are they in, are they actively seeking funds or casually, what type of investment do they seek, what benefits do they offer exchange, what is the offered equity etc.

- VC Firms Persona: Decision makers demographic information, position in the firm, digital activities, industry preference, maximum numbers of businesses they fund, smallest and largest fund size, are they actively seeking to invest or casually etc.

Once it’s sorted, you will know who you need to attract and how.

3. Value Proposition

This is largely dependent on your skills, strength and network. If you base Crunchbase as a reference and think that you will be credible at their level, you cannot reach that overnight. Rather offer a different value that will resonate more with your TG.

For example; if your are aiming to work with early stage startups, the value you can offer is connect them with 1 VC firms for free. Whether they can lock it or not, your next connections will require to pay you. This way, users will get to the first step with ease and they develop faith on your platform. Because they know you are actually offering valuable information and connections.

4. Competitive Advantage

Admit it, you cannot have a investors list of the same size as Crunchbase. If you want to compete with these sites; you need to develop an strength that they do not or cannot offer. I know it’s hard to discover but there must be be at least one. Let me share my thought.

Crunchbase is Bi…g, and they mostly with big firms. The small firms over there often get overlooked. Same thing goes to small and regional startups. They cannot afford to pay hefty fees to the platform and still fail to raise any funds as most of those firms don’t believe in wasting their time and money in such small opportunities.

Take that gap and use it to push small business with narrow VC firms that only fund in small sizes, seeks smaller equity and prefers sustainability over scalability. This can become your competitive advantage as well as an Unique Selling Proposition (USP).

5. Pricing Plans

If Crunchbase fees start from $79/month with various limitations, you need to be aiming for way lower for getting started if you want people to use your platform rather than CB. Why? Because Crunchbase already contains:

- Credible List; yours are still developing.

- Definite Success; the platform itself pushes you to get one. You cannot guarantee that in the beginning.

- Technical advancement; because they are in the market for long, their platform is way more feature-rich than yours will be in the beginning.

So to keep this things in mind, set your pricing in a competitive range. Offer free trial or a free plan to get users started.

Since you have figured out the five pre-requisites, you can start marketing your investors directory. I have a few ideas that you can incorporate.

Marketing Ideas to Grow Your Investors Directory

Your platform is online and you should aim to grow digitally. So your marketing approach will also be focused on online activities. However, you can also include a few conventional ideas to cover more touch points.

Digital Marketing Ideas for Your Investors Directory

- Social Media Marketing: Use platforms like LinkedIn, Twitter (X), Facebook etc. to communicate with your ideal target group. Share free fundraising ideas, get them hooked with webinars, live sessions and Q&A.

- Email Marketing: Collect emails of startups, VC firms and develop a lead list. Send them bulk or personalized emails using tools like FluentCRM or MailChimp. Or you can send regular emails one-by-one using your email composer highlighting the information you have and how they can benefit the receipants.

- Video Marketing: Use the power of visual motion to offer values. Create videos focused on fundraising tactics, Startups growth hacks, top 5 industries to invest in 2025 etc. Share them on platforms like YouTube, Dailymotion, TikTok, Instagram and embed them to your website as well.

- SEO: This is crucial for your platforms success. It brings inbound traffic through offering quality information to search engine queries. Optimize your listings to suit the queries by placing popular keywords in your listing descriptions, write blog focusing on startup challenges or investment ideas, link resources internally and externally to gain quality traffic.

- Outbound Marketing: Use cold outreach method to send messages to founders via LinkedIn, WhatsApp, Telegram etc. Or connect in Slack, Discord communities to let startup founders, VC firms inform about your platform’s offerings.

More Marketing Ideas

- Word Of Mouth: Encourage existing user base to spread the word of your directory, offer rewards like referral points, discount on their subscriptions and gift cards.

- Influencer Marketing: Collaborate with creators who focus on Startups and entrepreneurship so that they make content about your platforms and earn commissions from each conversion.

- PR and Community: Seek help from local media outlets like newpapers, news portals, TV stations to promote your platform. Get in touch with local business authorities to share your platform name with them.

- Sponsorship: Offer sponsorship to business community meetups, Startup workshops and various events.

I believe I have brought up sufficient ideas for you to grow the investors directory. But you need to make sure first that you are also enriching your listing quality, frequently updating and adding information, constantly growing the list to make the platform bigger. Don’t sleep on your early success, pave the way for a bigger gain.

Wrapping Up

This sums up our discussion of turning an idea into an opportunity by developing an investors directory with low-budget and short time. Crunchbase will keep growing the way it is, but that doesn’t elimitate the opportunity for a new platform to expand. You don’t need to become it’s alternative, rather focus on it’s gap and work on it to become something that your audience finds useful.

Don’t forget to share your thoughts on how to build an investors directory more efficiently. If you have liked the article, share it on your social media platforms and help entrepreneurs find more ideas to make money online. Join our affiliate program to help Directorist get more users so that you can earn comission on each referrals.

Leave a Reply

You must be logged in to post a comment.